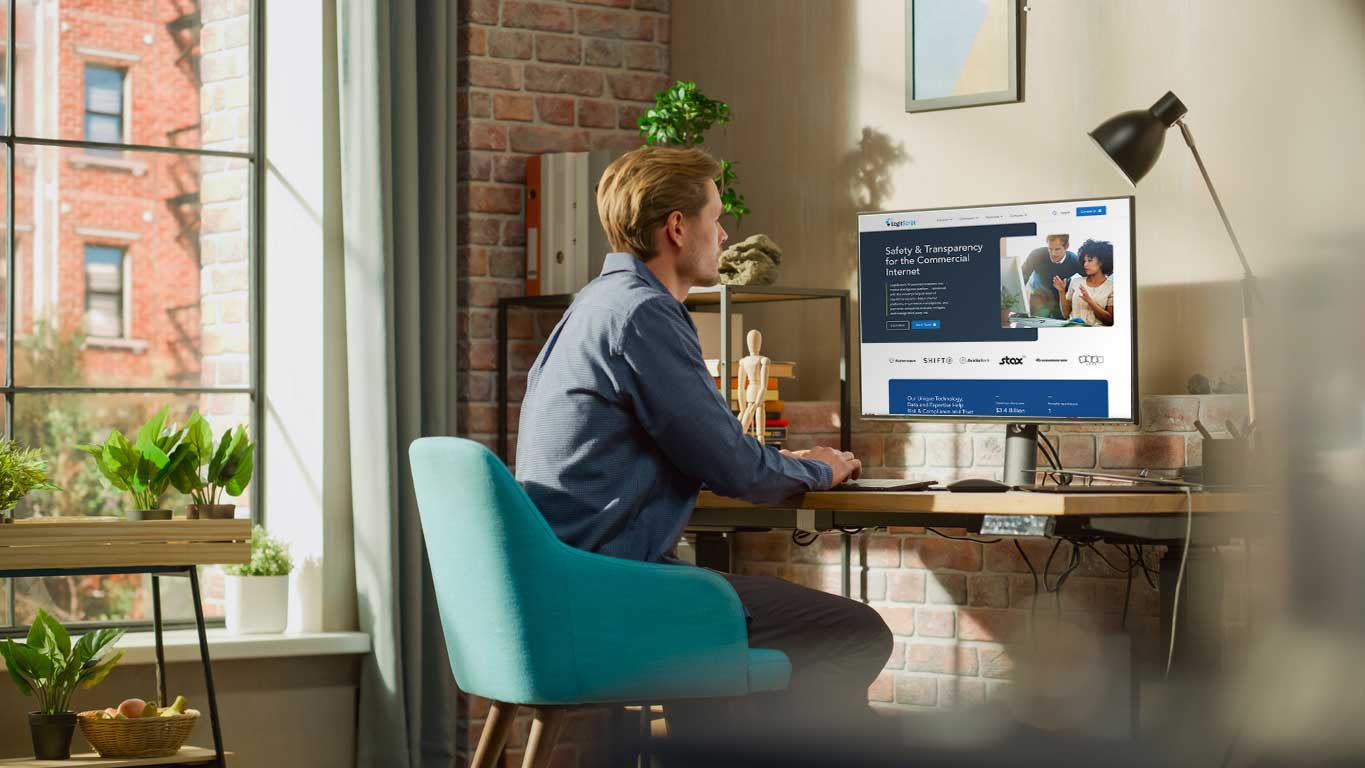

Reduce Risk in Your Merchant Portfolio

Confidently assess merchant risk of every type, including transaction laundering, to better avoid fines and expand growth opportunities.

Shopify

North American Bankcard

Avidia Bank

Flutterwave

Stax

Chesapeake Bank

West America Bank

No More False Positives, Data Dumps, and Long Risk Exposure Windows

LegitScript Merchant Onboarding helps you quickly vet prospective merchants before they enter your ecosystem, while LegitScript Merchant Monitoring helps you rapidly and confidently action existing merchants with accurate and detailed analysis of website content risk.

Minimize Risk Exposure

Reduce the risks associated with acquiring merchants in low-, medium-, and high-risk verticals in territories across the globe and in multiple languages.

Action With Confidence

Get accurate and detailed merchant analysis from LegitScript investigative analysts and regulatory experts to quickly action merchants and minimize your risk exposure.

Grow Your Business

Identify growth opportunities with support from our policy experts who track regulations and the most extensive data set of merchant activity across the commercial internet.

Get Full Coverage

With LegitScript Merchant Onboarding and Merchant Monitoring, you get full risk support through the entire merchant lifecycle, helping you mitigate risk at every step.

Stop Transaction Laundering and Other Complex Forms of Fraud

With a proprietary database comprising more than 15 years of problematic merchant data, our unparalleled view across payments ecosystems makes us the leader in transaction laundering detection.

LegitScript investigative analysts leverage our robust data set and advanced identification technology to:

- identify violative content

- perform investigative research

- identify transaction laundering

- map out fraud networks

- stop repeat violators

Avoid Scrutiny and Expensive Card Brand Fines

LegitScript’s unique combination of big data, advanced technology, and human review provides the most accurate merchant content risk monitoring to quickly identify card brand violations across verticals, geographies and languages.

Monitoring for 60+ high-risk verticals:

- Pharmaceuticals and supplements

- Online gambling

- Cannabis and CBD

- Weapons

- Adult and human trafficking

Increase Revenue by Exploring New Industries and Markets

Our experts track global regulations across high-risk verticals to help you explore new markets and revenue opportunities with confidence.

175+

Regulatory bodies

100+

Countries

60+

High-risk areas

Onboard Merchants Quickly and Confidently With Robust Data Sets

With more than 15 years of work with the world’s leading payments companies, search engines, social media companies, and e-commerce marketplaces, LegitScript has the most comprehensive view of payments risk on the commercial internet.

Now we’re pairing our RiskCheck solution with essential KYB checks to provide comprehensive merchant onboarding.

Learn More About Merchant Monitoring

Ready to Learn More?

Learn all about our best-in-class solution and see if it’s right for you and your risk and compliance team.

Discover More