Acquiring and Sponsor Banks

Get Visibility Into Downstream Merchant Risk

See how Sponsor Banks gain centralized, independent oversight across their ISO and payfac portfolios.

Sponsor banks carry regulatory, financial, and reputational risk for downstream merchants — but visibility is often fragmented, all-or-nothing, or dependent on manual reports and self-reporting from partners.

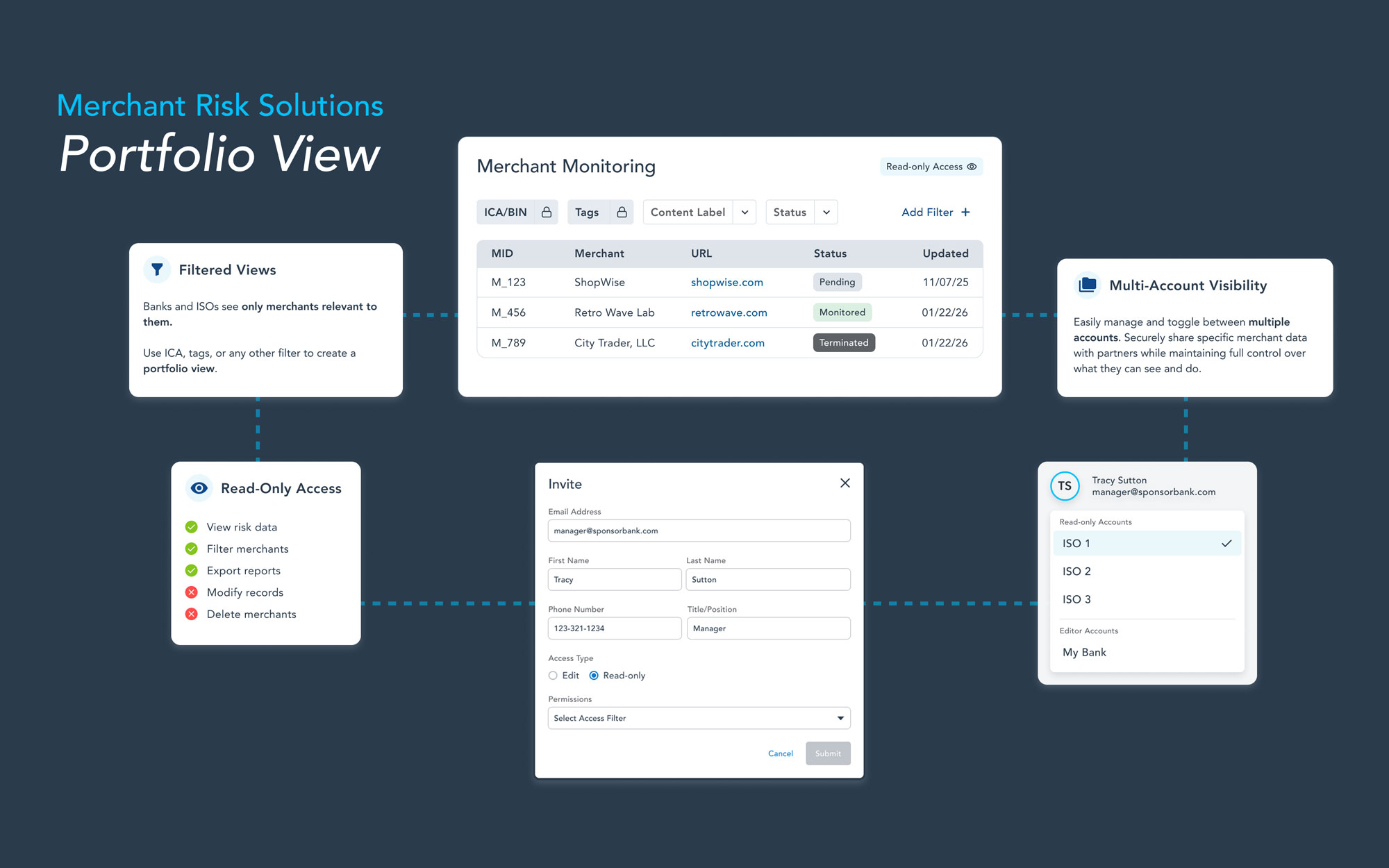

LegitScript Merchant Monitoring gives sponsor banks a centralized, standardized view of downstream merchant activity across ISO and payfac relationships, with secure, segmented access for internal stakeholders. The result is continuous, independent visibility into merchant risk — reducing blind spots, strengthening oversight, and supporting scalable, regulator-ready programs as portfolios grow.

See how it in action!

Sign up for a demo to learn how to:

- Standardize downstream risk visibility across all ISO and payfac relationships with a single, independent view

- Reduce reliance on manual reviews and self-reporting while detecting risk issues earlier

- Scale oversight without scaling headcount, even as portfolios grow and expectations increase

- Strengthen regulatory readiness with consistent, ongoing monitoring and reporting

- Leverage monitoring already in use by ISOs, extending visibility to the sponsor bank level without adding reporting burden