LegitScript Is Trusted by the World’s Leading Payment Companies to Reduce Risk With Continuous Monitoring Throughout a Merchant’s Life Cycle

North American Bankcard

Avidia Bank

West America Bank

Chesapeake Bank

Deepstack

Get the Visibility You Need to Avoid Fines and Confidently Scale

LegitScript helps banks identify and remove problematic merchants in their portfolios and in their downstream while empowering them to confidently expand into new industries and geographies.

Reduce Your Risk

LegitScript offers safer merchant onboarding and continuous monitoring, reducing your risk exposure through expansive data and deep expertise in more than 60 categories.

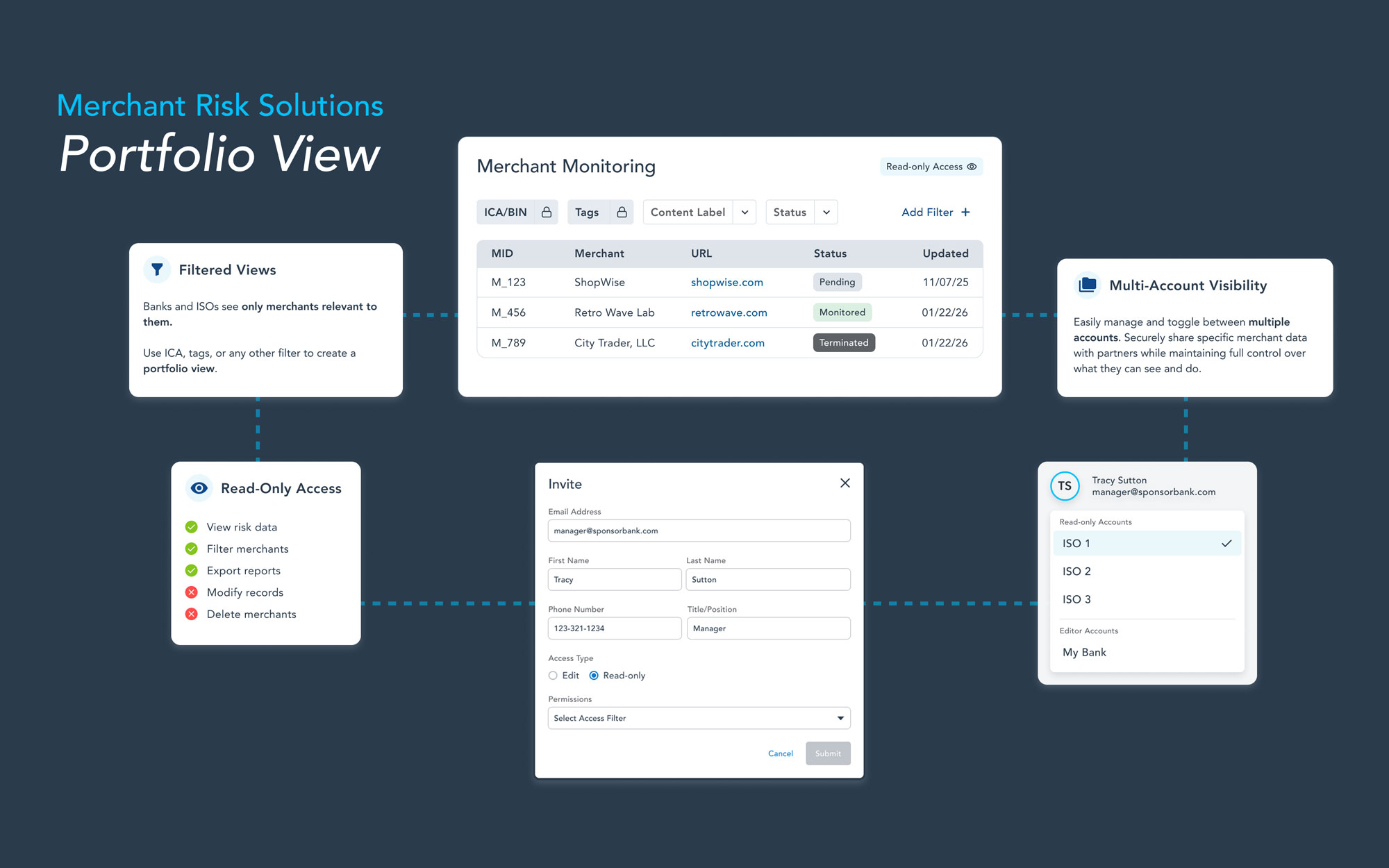

Downstream Visibility

LegitScript's Portfolio View enables sponsor banks to easily view the merchant portfolios of their ISOs and payfacs to track and manage downstream risk in real time — all in one centralized location.

Get Expert Analysis

Improve visibility across your ecosystem with detailed merchant analysis from investigative analysts and regulatory experts — with results that yield nearly zero false positives.

Grow Your Business

Identify growth opportunities with support from our policy experts who track regulations and the most extensive data set of merchant activity across the commercial internet.

Get better downstream oversight for end-to-end merchant compliance.

Portfolio View gives unparalleled visibility into downstream risk by centralizing and streamlining insights on ISO and payfac partners and their merchants. One flexible, searchable dashboard helps you reduce portfolio exposure and ensure compliance while simplifying oversight.

- Scalable portfolio monitoring

- Streamlined risk management

- Improved compliance oversight

- Reduced operational friction

LegitScript Helps Acquiring and Sponsor Banks Overcome the Challenges of Risk Mitigation

An overwhelming number of rules, organizational complexity, and opaque downstream can put your business at risk.

How Insufficient Merchant Risk Mitigation Impacts You

- Poor visibility into downstream merchants, compromising risk management and compliance oversight

- Operational friction due to manual reporting or needlessly complex workflows

- Unexpected card network fines or regulatory scrutiny

- Brand and reputational damage

- Increased operating costs associated with responding to card network violation notices

- Stressed relationships with card networks and downstream partners

- Financial losses and excessive credit risk

How LegitScript Helps You Manage Your Risk

- We work directly with downstream payment facilitators and ISOs to provide monitoring and better risk control.

- We give you scalable portfolio monitoring to manage multi-ISO or payfac portfolios efficiently, supporting oversight across complex structures.

- We help you streamline operations with advanced filters and easy navigation to you save time and effort.

- We reduce false positives and negatives, minimizing the risk of card network violations and making it easier to maintain good relationships with your upstream.

- We extend our in-house, industry-leading expertise about emerging trends, rules, and regulations to your team, providing cutting-edge thought leadership and insights.

Merchant Onboarding and Merchant Monitoring Buyers Guide

See LegitScript Merchant Onboarding and Merchant Monitoring in Action

Learn all about our best-in-class solutions and see if they're right for your risk and compliance teams.

Learn More About Merchant Risk Solutions