The Federal Trade Commission (FTC) has received more than 200,000 complaints so far this year about fraud related to the COVID-19 pandemic, with losses in the US totaling more than $146 million as of September 24, 2020.

According to the Commission's Consumer Sentinel Network, which has been tracking complaints since January 1, 2020, the median fraud loss of submitted complaints is $300. Although complaints peaked in late April and May, the FTC is still receiving hundreds of complaints a day from all over the country. California has one of the highest number of complaints at more than 10,000, followed by Florida (about 7,000), then Texas and New York (each about 6,500).

Types of Fraud

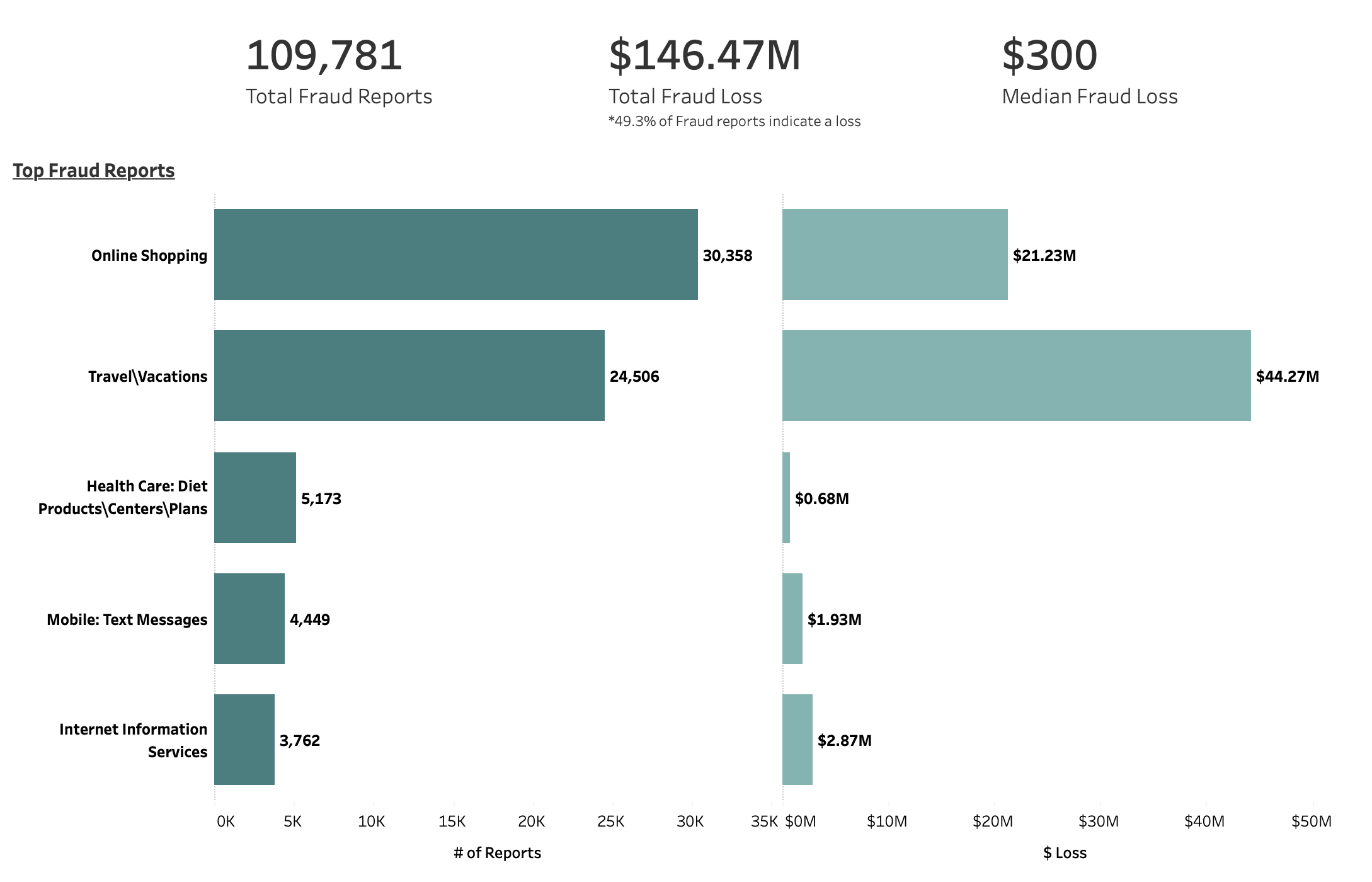

The tracker includes complaints related to identity theft, do-not-call transgressions, and other violations, but fraud comprises the majority of complaints. Of about 110,000 fraud reports, more than 30,000 were related to online shopping, and about 25,000 were related to travel and vacation scams. Reported losses from online shopping fraud has topped $21 million, while travel-related fraud has exceeded $44 million.

Online shopping has had the most fraud complaints so far. | Source: FTC COVID-19 Stimulus Reports

Payment Methods

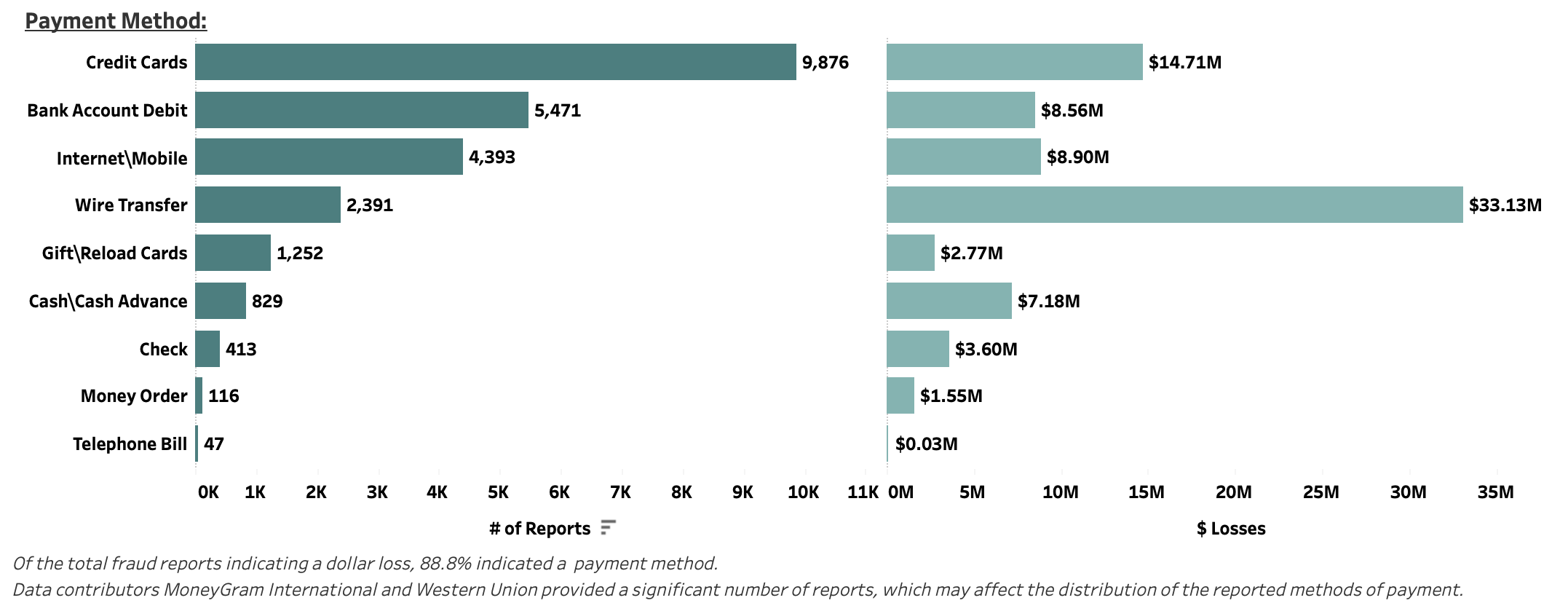

Credit cards constituted the payment method most often used in fraud, totalling nearly 10,000 complaints with a combined loss of $14.7 million. Wire transfers comprised a much smaller number of complaints (about 2,400) but have yielded the greatest amount of losses at more than $33 million.

Payment through credit card was almost as common in complaints as all other methods combined. | Source: FTC COVID-19 Stimulus Reports

Victim Demographics

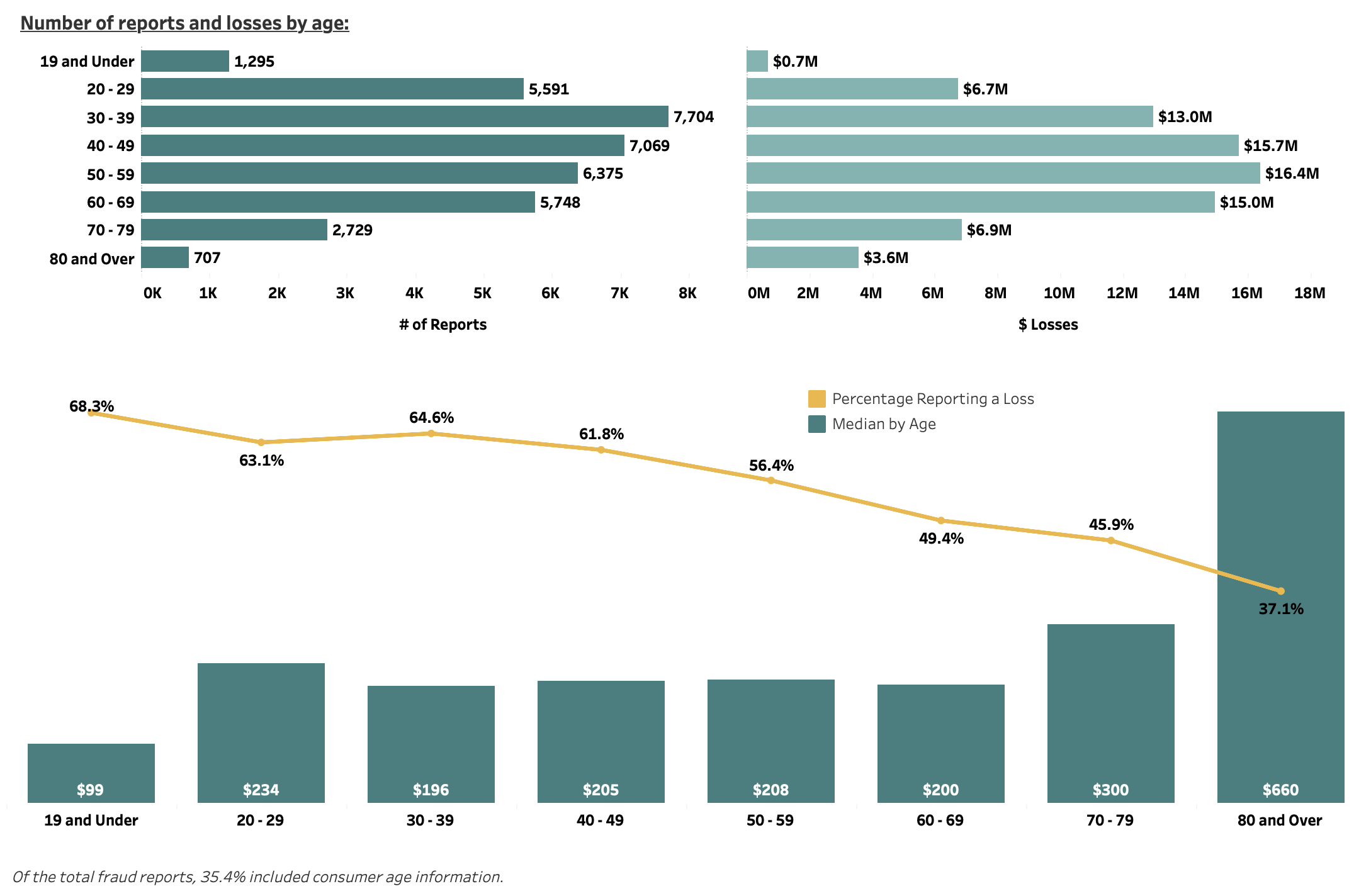

Where complainant age data was available, those who submitted the most reports were aged 30 to 39 (more than 7,700 complaints) followed by those aged 40 to 49 (about 7,000). However, the median loss for these ages was about $200, which is $100 less than the total median. Those aged 80 and older submitted far fewer complaints (about 700) but they reported suffering the greatest median loss at $660.

Complainants between 20 and 69 years of age reported only around $200 in losses, while those 70 and older reported much larger losses. | Source: FTC COVID-19 Stimulus Reports

Tracking Pandemic Fraud

LegitScript has been proactively monitoring the online space in response to the outbreak of the COVID-19 virus, and has identified a pervasive trend in the marketing of coronavirus-related products and activities that present an elevated risk to payments companies and online platforms. Our special report highlights the most critical illicit activity we are working to track, including high-risk domain name registrations, problematic diagnostics and supplies, bogus cures and treatments, rogue internet pharmacy opportunism, donation scams and nondelivery schemes, and more. Get it now.