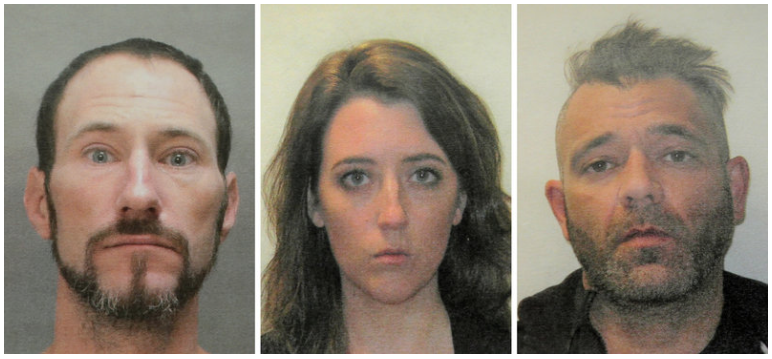

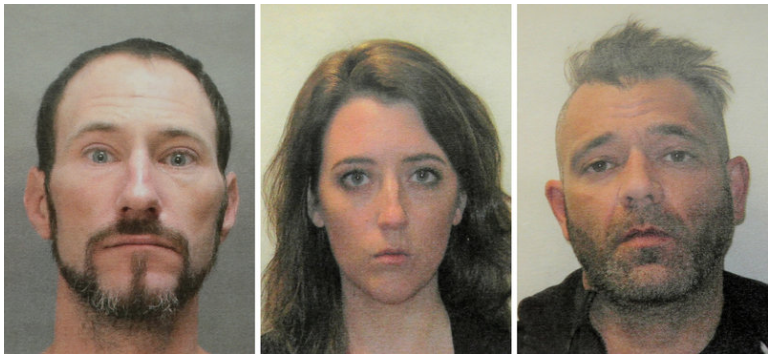

Suspected fraudsters Johnny Bobbitt (from left), Katelyn McClure, and Mark D'Amico | Photos courtesy Burlington County Prosecutors Office via NPR

This week, a New Jersey couple and a homeless veteran were arrested and charged with conspiracy and theft by deception for an alleged fraud scheme on the online crowdfunding platform GoFundMe. According to NPR, the three raised $400,000 from more than 14,000 donors based on an allegedly fabricated story of a Good Samaritan. It's the latest high-profile scam to draw attention to online aggregators and the risks they pose for payment facilitators.

Although the GoFundMe page for this fundraiser is now inactive, the fundraising campaign was built around a story that, in November 2017, a homeless man gave $20 to a stranded female motorist whose car ran out of gas on a freeway exit in Pennsylvania. According to reports, the stranded woman got home and, with the help of her boyfriend, began a GoFundMe campaign on the homeless man's behalf to thank him for his kindness. But in September 2018, police raided the couple's house on suspicion that the pair was misusing the donations. Further investigation led to charges that all three, including the homeless man, conspired to concoct a false story and defraud donors.

These cases of alleged fraud are rare, but they highlight the risks involved with aggregator merchants such as GoFundMe. What is aggregation? It typically refers to merchants who are allowing other merchants' transactions to flow through their accounts, rather than requiring platform users to sign up for their own merchant accounts. This can take many forms, most frequently as crowdfunding websites (such as GoFundMe and Kickstarter), services that facilitate transactions between two parties via a website or an app (such as Uber and Lyft), marketplaces where third-party merchants can post their merchandise (such as eBay), and payment processors (such as PayPal).

Although many aggregator merchants are legitimate, merchants engaged in aggregation may pose elevated risk by introducing high-risk merchants downstream, and such aggregation is not always authorized. Even legitimate aggregators can face a higher risk of chargebacks. In the case of the allegedly fabricated story about the homeless man, a GoFundMe spokesman stated the company would refund the donations to all 14,000 donors.

There are other reasons payment aggregators carry elevated risks, which can be amplified depending on the type of aggregation in which they are engaging. First, there is the issue of consumer safety. Aggregators that require consumers to provide them with personal information, such as their bank account information, need to be properly vetted by acquirers to ensure that they can be trusted with consumers' information. Second, if the merchant is a third-party payments aggregator (or marketplace) such as eBay, they have less control over what the individual merchants are selling.

Unauthorized aggregation is just one of the high-risk categories LegitScript helps monitor. We combine technology with human expertise to proactively monitor portfolios for merchants engaged in a range of high-risk activity. Want to learn more about our services? Contact us to explore our merchant monitoring service offerings.