As the gambling landscape continues to evolve, sweepstakes casinos are gaining in popularity — and in regulatory scrutiny. In LegitScript’s July 2025 webinar, “Social Gaming and Sweepstakes Casinos: Risks and Regulations Around Novel Forms of Gambling,” Associate General Counsel Andy Bayley broke down the complexities of these models and the risks they present for payments service providers, internet platforms, and consumers alike. Read the post and then watch the webinar.

July 21, 2025 | by LegitScript Folks

What Are Sweepstakes Casinos?

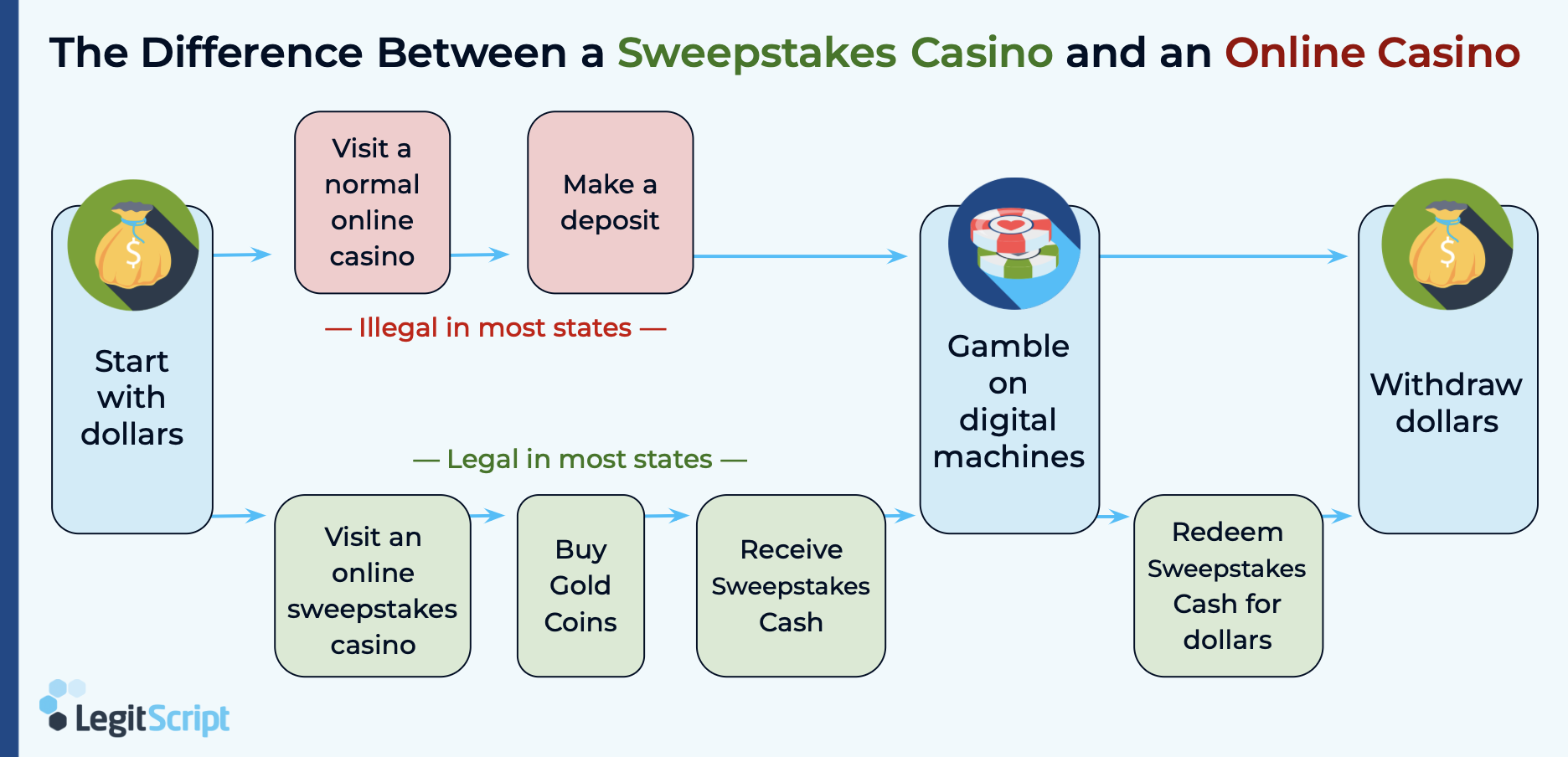

Sweepstakes casinos are online platforms that mimic traditional gambling but use a “dual currency” system to skirt gambling laws. Instead of betting directly with cash, players purchase digital assets usually called “gold coins” for gameplay. With those purchases, they typically receive bonus “sweepstakes coins,” which can then be exchanged for real money. Although these platforms often look very much like traditional online casinos, this structure allows these casinos to technically be categorized as sweepstakes rather than gambling.

This model — often marketed as “free to play” — is legally dubious and varies in acceptability depending on the jurisdiction.

The Dual Currency System: A Legal Loophole?

The heart of sweepstakes casinos lies in their two-currency structure:

- Gold Coins: These digital tokens have no monetary value and are used for social or entertainment gameplay. These are often given away at first, and players can purchase more when they run out.

- Sweepstakes Coins: These cannot be purchased directly but are awarded as bonuses or via free methods. They can be redeemed for real-world cash.

While this model attempts to bypass gambling classifications, several states — and regulators — are increasingly calling foul. See the graphic below for how sweepstakes casinos operate compared to traditional online casinos.

U.S. Gambling Laws Are All Over the Map

Federal laws like the Wire Act, UIGEA, and the Illegal Gambling Business Act provide baseline regulations, especially for interstate betting and payment processing.

Each state interprets gambling and sweepstakes casinos differently. For example:

- Montana bans sites that allow users to “place a bet or wager using any form of currency, and makes payouts of any form of currency.”

- Washington broadly defines gambling and has found social-style gaming operators to meet the state law definition of gambling.

- New York recognizes the value of virtual currency in determining legality, which closes the dual-currency loophole.

This patchwork of laws makes compliance a significant challenge.

How to View Sweepstakes Casinos

Enforcement Is Difficult (and That’s the Point)

These platforms often go out of their way to obscure what they’re actually offering. Complex language, colorful graphics, and vague terminology make it difficult for automated systems and regulators to classify their operations. The rise of cryptocurrencies and digital assets adds further complexity.

Be Aware of the Risks

If you support sweepstakes casinos or are considering doing so, it’s important to mitigate your risk. Here’s what businesses should watch for:

1. Youth Access Controls: Weak verification systems are common, and in fact some platforms include marketing and branding that appeal to youth.

2. Fraud & Chargebacks: High rates are common because of the nature of digital purchases.

3. Transaction Laundering: Some sweepstakes casino operators may make use of transaction laundering to covertly process payments without your knowledge.

4. No Auditing Requirements: Unlike regulated gambling, sweepstakes casinos aren’t generally required to adhere to fairness standards and may offer minimal data security to users.

Gambling-Adjacent Concerns

In addition to sweepstakes casinos, LegitScript tracks other gambling-adjacent activity that may pose reputational risk and could be considered gambling in some jurisdictions:

- Loot Boxes: Popular in many digital games and apps, these are randomized digital items that players can pay to open.

- Skin Gambling: These in-game items — which customize weapons, outfits, and more — are sometimes used to place bets.

- E-sports Betting: This practice is often unregulated and tends to appeal to youth.

How LegitScript Can Help

Navigating the evolving world of sweepstakes casinos and social gaming requires expert insight and proactive risk management. LegitScript helps companies like yours mitigate your risk while growing your business.

For Payments Service Providers:

- Merchant Onboarding & Monitoring: Our merchant onboarding and monitoring services can identify traditional gambling offers and specify those operating entirely with virtual currencies.

- Transaction Laundering Detection: We can identify transaction laundering beneath the surface of the merchant’s gaming operation.

- MCC Detection: Our services can also identify if the merchant is properly coded for offering betting services versus digital goods and gaming

For Online Platforms:

- Ad Monitoring: Our monitoring can identify gambling-related advertisements that violate your platform’s policies.

- User-generated Content Monitoring: We can detect content that is facilitating access to online gambling websites in violation of your policies.

- Risk Landscape Reports: Our services can also investigate emerging gambling-related threats and analyze the impact to your platform.

Contact us to learn how we can help your organization identify, manage, and mitigate risks associated with sweepstakes casinos and social gaming.