As payment ecosystems grow more complex, sponsor banks are under increasing pressure to maintain effective oversight of their downstream merchant portfolios.

With multiple ISOs and payment facilitators (PayFacs) in the mix — and evolving card brand rules and global regulatory requirements — managing merchant risk at scale has never been more challenging. Keep reading to learn how LegitScript is tackling this challenge.

LegitScript’s Merchant Risk Solutions are designed to help sponsor banks, payment service providers, and PayFacs manage the full merchant lifecycle, from onboarding through continuous monitoring, with unmatched visibility into online merchant risk.

A Standardized View of Merchant Risk — Across Every Relationship

LegitScript Merchant Risk Solutions give sponsor banks a single, standardized view of downstream merchant risk across all ISO and PayFac relationships. Instead of relying on fragmented reporting or manual processes, banks gain consistent, actionable insights that reduce portfolio exposure while simplifying oversight.

This standardized approach not only strengthens risk governance, but also enables sponsor banks to differentiate themselves by offering ISOs and PayFacs a more transparent, trusted sponsorship model.

With LegitScript, sponsor banks can:

- Maintain end-to-end accountability for merchant oversight as card network rules and global regulatory expectations continue to expand.

- Leverage expansive risk intelligence, including global detection across more than 60 high-risk categories.

- Gain cross-platform visibility spanning merchants, advertising platforms, online marketplaces, and social media.

- Enable safer onboarding and continuous monitoring through automation, real-time risk insights, and expert partnership support.

- Standardize oversight and reporting across all ISO and PayFac relationships, creating a scalable view of downstream merchant activity and enabling earlier detection of emerging risk and policy violations.

Visibility Into Your Downstream Merchant Portfolios

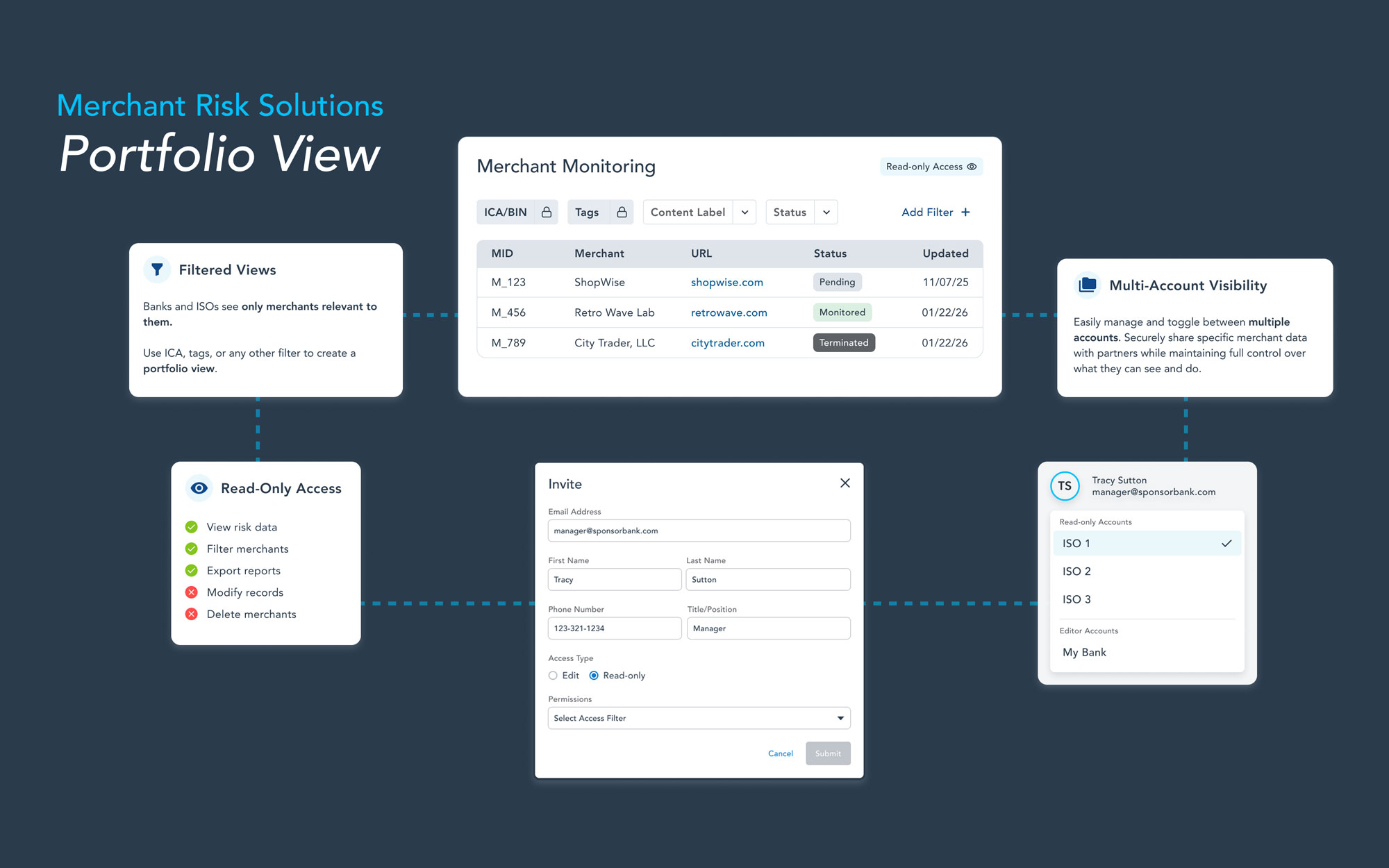

LegitScript’s Portfolio View gives sponsor banks a clear, centralized way to monitor merchant risk across each ISO and PayFac relationship — all in one place.

With Portfolio View, sponsor banks can:

- Scale portfolio monitoring with confidence using acquirer-specific views that support oversight across complex, multi-ISO or PayFac structures.

- Streamline risk management with advanced filters that allow teams to sort and analyze merchants by risk level, MCC, or other criteria — significantly reducing manual work.

- Improve compliance oversight by enabling compliance teams to efficiently monitor and audit merchant portfolios without compromising data integrity.

- Reduce operational friction by eliminating spreadsheets and manual reporting, allowing for faster, more accurate risk reviews.

Turning Visibility Into a Competitive Advantage

As regulatory scrutiny intensifies and merchant portfolios expand, visibility is no longer optional: it’s a competitive advantage. LegitScript empowers sponsor banks to move beyond reactive risk management and toward proactive, scalable oversight that protects their business while supporting responsible growth across their partner ecosystem.

Looking for centralized, independent oversight of your ISO and PayFac portfolios?