Veterans Day is a popular time for businesses to advertise to the military, including merchants offering predatory services. For this reason, it's important for payment service providers to scrutinize merchants offering help with official services to ensure they aren't taking advantage of customers.

For example, some merchants offer to help retired military members process form DD-214, which is a discharge and separation document that is required for veterans to claim military benefits such as college education discounts, VA loans, and medical benefits. This form is only available through the National Archives, and can take weeks to process.

Some merchants specializing in veterans services claim they can process the forms faster, but in actuality they simply submit the form to the National Archives on the behalf of the applicant for an added cost. This no-value-added service may face heightened scrutiny because it targets veterans, who, according to the FTC, lose 44% more money to fraud than civilians. Between 2015 and 2019, the FTC received about 163,000 fraud reports from military retirees and veterans; median losses were $950 compared to $658 for civilians.

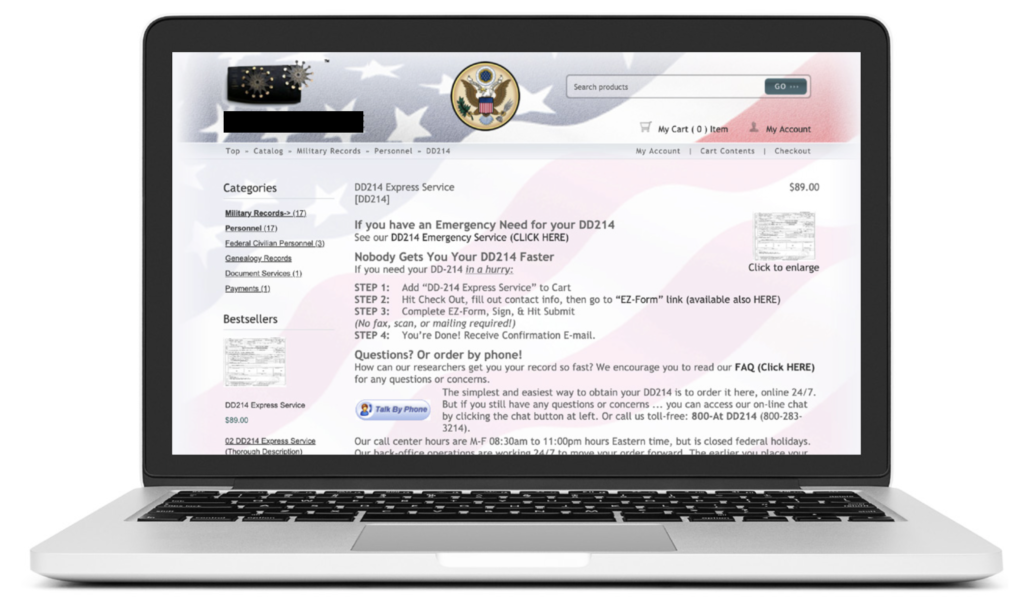

A merchant with a website designed to look official offers an "expedited service" of DD-214 forms for $89.

What to Watch Out For

- Merchants that promise to process government forms faster than the government

- Websites that look strikingly similar to government websites offering the same service

- Merchants with products or services tailored to veterans or members of the military

Want to learn about other trends that tend to recur on an annual basis? Download LegitScript's Seasonal High-risk Trends Guide.