With holiday spending set to rise this year — especially through online shopping — the expected surge in transactions makes payment processors and online marketplaces vulnerable to increasingly sophisticated scams and other high-risk behaviors that are becoming harder to spot as fraudsters integrate new techniques into their schemes.

Keep reading to learn about illicit and brand-damaging merchant behavior that can spike during the holiday season as shoppers open their wallets.

November 4, 2025 | by LegitScript Folks

AI-assisted Nondelivery Schemes

Nondelivery schemes — scams in which merchants market products that customers pay for but which are never delivered — are a favorite of internet fraudsters. But new AI-powered website builders are making it faster than ever to churn out sleeker, more sophisticated merchant websites. This makes it harder than ever for underwriting and risk & compliance teams to spot suspicious websites. Furthermore, the operators of these so-called “ghost stores” now sometimes even provide fake tracking numbers to further dupe customers and delay chargebacks.

Nondelivery scammers often feature in-demand products on their website, such as popular electronics or brand name clothing and accessories. These types of goods are popular gift items, which is why these scam websites are especially active during the holiday season.

What to Watch Out For

Merchants engaged in nondelivery are notoriously difficult to catch. Because no inventory exists, it’s easy for them to pivot to whatever product is currently en vogue. However, indicators of a nondelivery website may include:

- A bare-bones website that may look sleek at first glance but lacks typical website pages such as About, Contact, Terms, etc.

- Frequent spelling errors or content that appears to have been copied from another website

- Strange or illogical pricing

- Lack of a wider web presence, such as social media accounts

Fake Product Reviews

Product and seller reviews were once a dependable way for customers to share authentic experiences and help others make informed decisions, especially when holiday shopping. But as competition for online sales has intensified, a shadow industry has emerged around buying and selling fake testimonials and social media engagement.

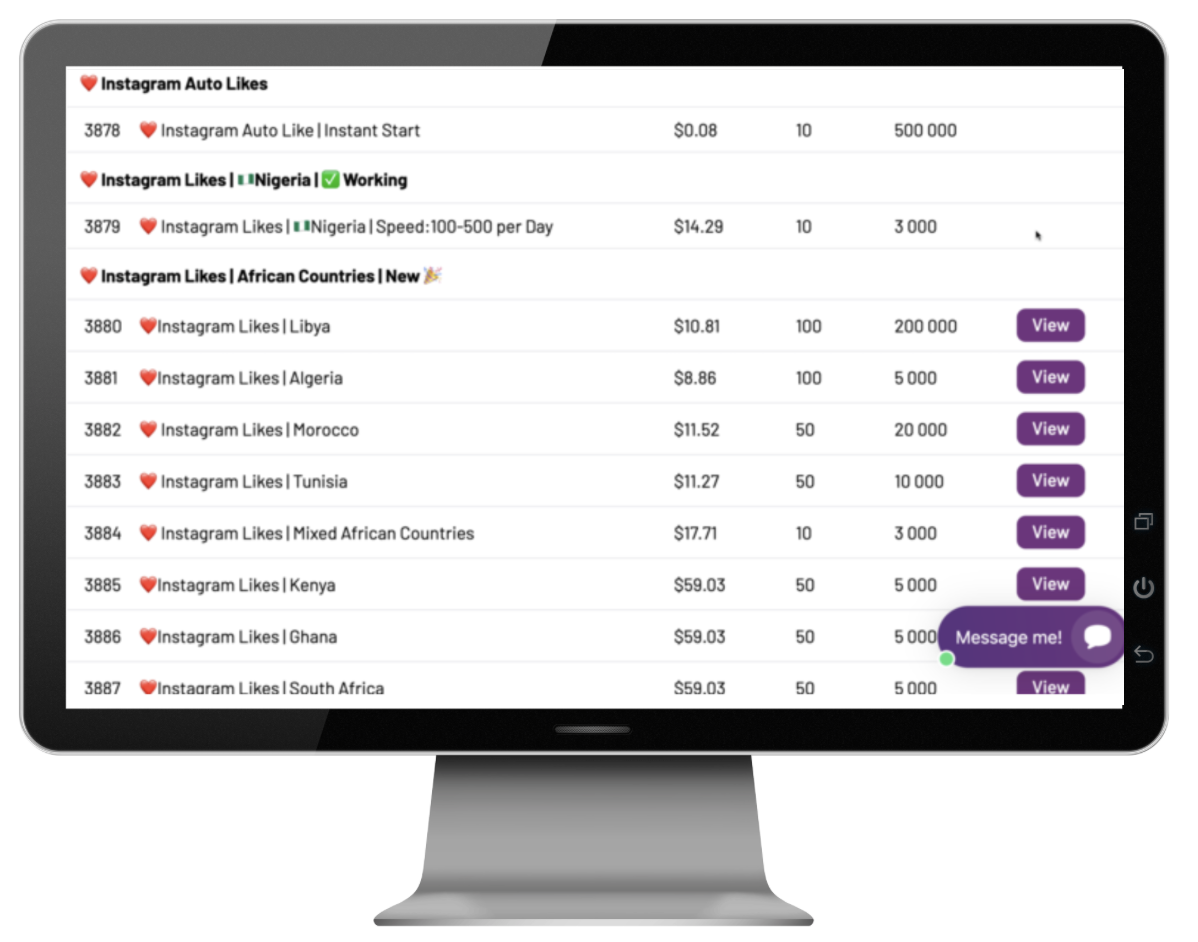

Some specialized operations recruit individuals to post glowing reviews in exchange for payment or free merchandise. Others use software services that generate automated “bot” reviews in bulk. There are other services that sell bundles of thousands of likes or follows on their preferred social media platform, with options to select engagement from accounts linked to certain age demographics or regions.

Why Do Fake Reviews Matter?

The U.S. Federal Trade Commission (FTC) finalized a rule in 2024 banning the use of fake reviews and testimonials. The new rule clearly prohibits the use and sale of fake reviews under federal law to distort the information that consumers rely on to make purchasing decisions.

The FTC has also updated its guidelines on endorsements to reflect changes in digital marketplaces. Social media influencers must now disclose any financial or material relationships they have with the products they promote. Additionally, the buying and selling of fake social media followers or views with the aim of artificially inflating a merchant’s reputation is now prohibited. The Commission can now impose civil penalties against violators.

For payment service providers, supporting merchants involved in fake review schemes is more than a reputational concern; it can lead to regulatory scrutiny for enabling deceptive business practices. For online marketplaces, it degrades the user experience and erodes trust in the platform.

IP-infringing Counterfeit Products

In the third quarter of 2025, 21% of all accounts that LegitScript reported with BRAM- and VIRP-level risk were offering IP-infringing goods. In fact, counterfeit product sales comprised the largest category of high-risk merchant websites LegitScript flagged. And although the commercial internet is rife with counterfeit products year-round, sellers make an extra push during the holiday season as shoppers hunt for deals on popular products.

Merchants engaged in IP infringement can be complex to evaluate because most of the products with violative design lack overt replica marketing. LegitScript has reported merchants as high risk for IP violations when their seemingly non-genuine products are marketed as brand-name products, which may violate trademarks.

What to Watch Out For

While it may be difficult to definitively verify whether a merchant is selling counterfeits, there are risk factors that can trigger extra scrutiny. These include:

- Merchants offering commonly counterfeited products, such as Apple Airpods, Nike shoes, Disney toys, or luxury brand accessories

- Merchants using common keywords that denote replicas and refer to the quality of counterfeit products, including AAAA, AAA+, and 1:1

- Domain names that appear suspiciously similar to brand websites (e.g., apple.cc or appleiphones.com)

- Suspiciously low prices

It is an industry best practice for e-commerce marketplaces and other internet companies to request evidence of permissive use from merchants that do not clearly own the rights to the intellectual property they sell.

Predatory Christmas Loans

“Christmas loans” or “holiday loans” are payday-style loans that consumers use for expenses related to holiday spending, such as shopping or travel. Many payday lenders make an aggressive marketing push during this season to capitalize on the extra spending.

It’s important to scrutinize merchants offering personal loans because of their potentially predatory nature. Payday loans can trap people in an endless cycle of borrowing. The Center for Responsible Lending notes that more than four out of every five payday loans are re-borrowed within a month, and that these lenders earn most of their revenue from borrowers who take more than 10 loans a year.

It’s not just a potential reputational risk for payment processors: the lending industry is highly regulated, and there have been efforts to protect consumers from predatory loans. The risk and the elevated potential for regulatory action typically leads payment processors to limit their exposure to lending, particularly with online lenders.

What to Watch Out For

- Merchants offering a wide range of loan types

- Merchants guaranteeing fast approval, in hours or even minutes

- Merchants that aggressively solicit borrowers with poor credit

LegitScript Helps You Stay Abreast of Seasonal Trends

The commercial internet is dynamic, and high-risk trends can ebb and flow depending on the season, the news cycle, and regulatory priorities. As technology and tactics continue to evolve, problematic merchants will look for new ways to perpetuate old high-risk behavior.

Our Merchant Risk Solutions and Platform Risk Solutions help you detect and monitor high-risk trends to reduce your exposure to regulatory scrutiny and card brand fines. Contact us to learn more.