CBD Certification

Maximize your online visibility and build trust with consumers by certifying your eligible CBD products and websites.

Why LegitScript CBD Certification?

LegitScript’s certification program is recognized by Google and Meta to vet advertisers for eligible CBD products and websites. CBD manufacturers and retailers with LegitScript-certified websites can stand out in an increasingly crowded field by advertising on Google and select Meta platforms.

Per LegitScript CBD Certification standards, which Google’s CBD ad policy and Meta's CBD ad policy lean on, both a website and all CBD products being offered on it must be certified by LegitScript to be able to advertise these products on these platforms.

The Following Partners Recognize LegitScript's CBD Certification Program

The benefits offered primarily depend on if you are a CBD manufacturer or retailer:

Why Get Certified

- Demonstrate trust with consumers by letting them know you operate safely and transparently, and that your products have been tested.

- Gain approval from the certification expert relied on by some of the world’s largest payments companies and internet platforms.

- Grow your business by encouraging more retailers to carry your products.

Applicants get their LegitScript certified CBD products included on a select list of certified products visible to the public. Certified CBD retailers, who must have a catalog that consists of only LegitScript certified CBD products, can choose certified products from this list to sell on their websites.

We welcome CBD manufacturers to collaborate with certified CBD retailers to promote their certified CBD products.

Additionally, manufacturers selling only LegitScript-certified products can get their websites certified to become eligible to advertise on Google and select Meta platforms. Click the CBD Website Certification tab to learn more about that process.

How it Works

- CBD applicants submit eligible CBD products to be certified.* Use promo code CBDPRODapp at checkout to get your application fee waived.

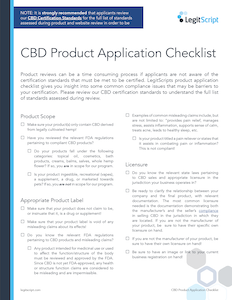

* Examples of in-scope products include cosmetics, soaps, topicals, and other products that are in compliance with USDA, FDA, FTC, and DEA regulations, as well as state-specific laws. See our product application checklist to learn more. - CBD products are reviewed for compliance against our Certification Standards and sample tested for consumer safety. For more information on the application process, see process and pricing.

- All certified CBD products are included on a select list linked from LegitScript's CBD homepage that retailers can choose from to advertise on their certified websites.

- Retailers who have a CBD product catalog that consists only of LegitScript-certified products are eligible to submit their websites for LegitScript certification, a requirement for advertising on Google.*

* Manufacturers with a CBD product catalog that consists only of LegitScript-certified products can also choose to submit their websites for LegitScript certification. Having only product certification(s) without website certification is insufficient for advertising on Google and select Meta platforms.

Note: In addition to receiving LegitScript’s CBD Certification, advertisers must comply with all externally available Google and Meta ads policies in order to advertise on these platforms.

For more information on the application process, see process and pricing.

Who is Eligible

- CBD applicants submitting eligible CBD products*

* Examples of in-scope products include cosmetics, soaps, topicals, and other products that are in compliance with USDA, FDA, FTC, and DEA regulations, as well as state-specific laws.

Who is Ineligible

- CBD applicants submitting ineligible products such as supplements and pet products containing CBD, vapes, and ingestible CBD of any kind, including sublingual tinctures.

Are you ready to be certified?

Download our product application checklist for a quick review of qualifications.

NOTE: It is strongly recommended that applicants review our CBD Certification Standards for the full list of standards assessed during product and website review in order to be certified.

Coverage

LegitScript CBD Certification is recognized wherever eligible CBD products are permitted (US only). Currently, Meta recognizes LegitScript-certified websites for ads throughout the United States. Per Google’s policy, advertising your certified website using Google Ads is available in California, Colorado, and Puerto Rico.

CBD Compliance Resource Guide

Demonstrate Quality

CBD regulations are always changing. But what customers want remains the same: quality, transparency, and safety.

When your CBD website is LegitScript-certified, customers can rest assured your CBD products check all the boxes: Third-party tested. FDA-compliant. Free of impermissible levels of THC. Read more about our standards for getting certified.

Learn More About Becoming Certified

A Partner You Can Trust.

Expertise You Can Rely On.

As the leading third-party certification expert in the complex CBD industry, we’re here to help you succeed beyond your certification. Begin your certification journey by starting an application or learning about the questions we’ll ask and the documents we’ll need.

Discover More